Benefits of Outsourcing Check Processing

Doing so will offer a variety of benefits, worth a lot more than the amount that you will have to pay for the services. The key idea is to choose a service provider with a good reputation and can handle the job on behalf of your business. Some of the top benefits of outsourcing check processing are highlighted below.

Doing so will offer a variety of benefits, worth a lot more than the amount that you will have to pay for the services. The key idea is to choose a service provider with a good reputation and can handle the job on behalf of your business. Some of the top benefits of outsourcing check processing are highlighted below.

It Reduces Costs

Outsourcing the check processing tasks will significantly reduce the costs of your business. That means you get to save quite a lot while still getting the job done effectively. For example, outsourcing means that you will not have to hire employees to deal with the job, which would add to the salary budget. Employees may also need micromanagement, which is time-consuming. When you outsource, you only pay for particular services and do not have to worry about anything else.

It Increases Security

For as long as you choose a trustworthy company to handle all your check processing tasks, your finances will be a lot more secure. The information regarding your finances might be a bit difficult to secure internally and may require you to put up systems and protocols that will be an extra load to your finance team. By outsourcing, the payment processing company will be responsible for securing all the information, allowing your team to focus more on growing your business.

It Can Improve Vendor Relations

Outsourcing the check-processing job to a reliable company will result in more accurate and faster payment processing. Getting timely payment without having to go through much hassle is one of the ways to improve the relationship between your business and vendors. Depending on the payment processing service that you choose, the vendors can also be constantly kept on the loop regarding their payments, which is also a plus.

It Provides Flexible Payment Solutions

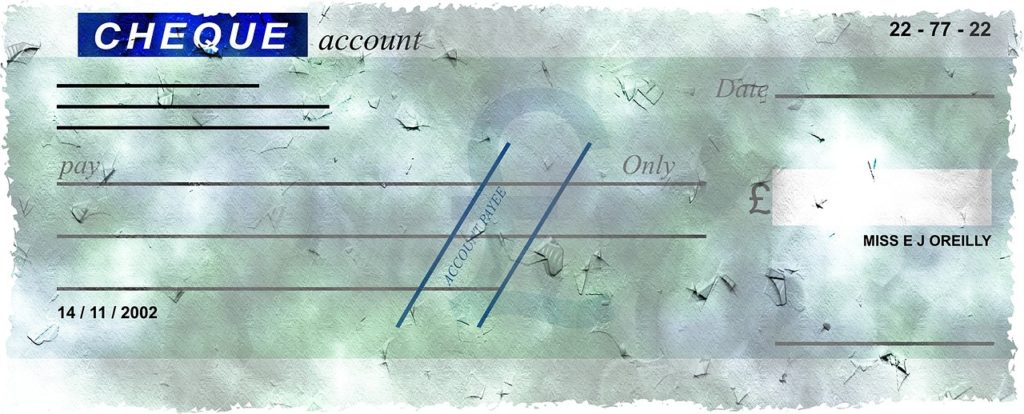

Outsourcing check processing can add to the number of payment solutions that you can use. With third-party check processing, the payment system will be highly configurable, such that it can meet the various needs of your vendors. It also allows you to monitor the status of all payments in real-time. For checks, there can also be customization of fonts, logos, and signatures, which helps a bit with branding. The service will include folding and sealing of checks as well as the mailing process.…