3 Ways to Attain Financial Stability

Are you tired of living paycheck to paycheck? Are you struggling to make ends meet every month? If so, you’re not alone. A recent study found that nearly 60% of Americans don’t have enough money to cover a $500 emergency. That’s a scary statistic.

This is because they might be facing credit problems. If you are also in one, you should consider hiring credit repair companies. If you check out this guide, you can learn more about it. Here, we will discuss the three ways to attain financial stability and improve your financial situation.

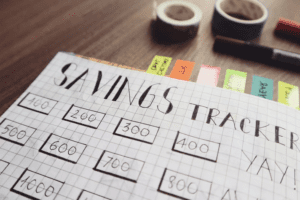

Prioritize Saving

One of the best ways to achieve financial stability is to prioritize saving. It may seem difficult to save money when you’re already struggling to make ends meet, but it’s important to remember that even small savings can add up over time. If you can put away just $50 per month, you’ll have $600 saved up after one year. And if you can increase your savings to $100 per month, you’ll have $1200 saved up after one year. No matter how small your savings may be, they can still make a big difference in your overall financial situation.

One of the best ways to achieve financial stability is to prioritize saving. It may seem difficult to save money when you’re already struggling to make ends meet, but it’s important to remember that even small savings can add up over time. If you can put away just $50 per month, you’ll have $600 saved up after one year. And if you can increase your savings to $100 per month, you’ll have $1200 saved up after one year. No matter how small your savings may be, they can still make a big difference in your overall financial situation.

Create a Budget

Another important step to take if you want to achieve financial stability is to create a budget. If you don’t know where your money is going each month, it’s difficult to make wise spending decisions and save money effectively. By creating a budget, you can track your spending and make adjustments as needed. There are several different ways to create a budget, so find one that works for you and stick with it. A budget will help you stay on track and make progress toward your financial goals.

Build an Emergency Fund

Last but not least, one of the best ways to achieve financial stability is to build an emergency fund. This will help you cover unexpected expenses without going into debt. Aim to save enough money to cover at least three months of living expenses. You’ll be in good shape financially if you ever face a job loss or another financial emergency if you can do. Many people have been forced into debt by unexpected expenses, so an emergency fund can be a real lifesaver.

Last but not least, one of the best ways to achieve financial stability is to build an emergency fund. This will help you cover unexpected expenses without going into debt. Aim to save enough money to cover at least three months of living expenses. You’ll be in good shape financially if you ever face a job loss or another financial emergency if you can do. Many people have been forced into debt by unexpected expenses, so an emergency fund can be a real lifesaver.

While there is no one-size-fits-all answer to how to achieve financial stability, hopefully, these four tips will provide you with a good starting point. If you are struggling to make ends meet, it might be time to look at your spending and saving habits and see where you can make some changes. Consider talking to a financial advisor or accountant who can help give you tailored advice on how to get your finances in order. What steps are you going to take today towards achieving financial stability? Please share it with us in the comments.…